Funding. In particular, Student Funding. It’s the hot topic every September and then people tend to forget about it until the student population protests and then it’s forgotten again. But we don’t need to talk politics.

Medical School finance is one of the great mysteries in the world but once you get to grips with it, the fog clears and the debt sign shines brightly ( joke ).

So, because this blog is aimed at graduate students, I am going to talk about how to fund medical school as a graduate on a graduate entry programme … Bring on the diagrams!

So firstly, the tuition fee. At the moment the tuition fee’s stand at £9,250 but this will change. I don’t like to say it will but it’s inevitable. So you need to keep on top of any changes. Universities will display this on their websites so it will be easy to identify any changes.

Graduate courses are mostly funded by the government and the NHS, except from the first year where you will need to find £3,465 of your own money to pay for it. People do it many different ways, I myself was lucky enough to have savings. However, some medical schools, like Warwick, allow you to pay in instalments so you could use some of your patience loans to pay for it.

After Year 1, tuition fees still remain (if the government allows it) at £9,250. Again, THIS IS SUBJECT TO CHANGE. However, the NHS bursary kicks in and the NHS pays £3,715 whilst student finance pays £5,535. So, beyond year 1, you don’t have to worry about paying your tuition fees.

So, you have sorted out paying for your actual course, but what about things like eating? This is where the maintenance loan comes into play ( just to let you know I have written this section twice now because my elbow decided to close my last window…..)

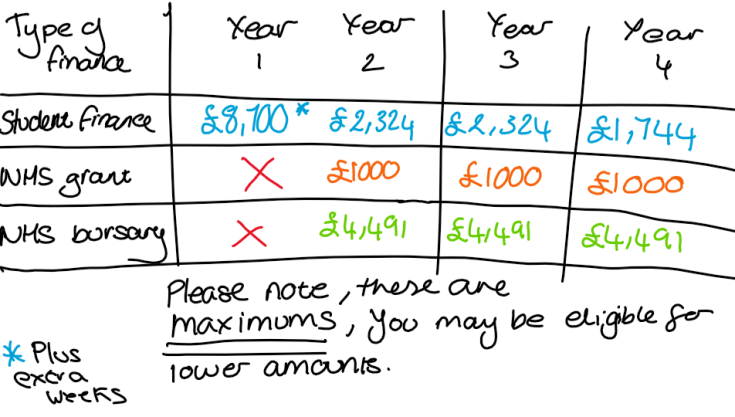

In your first year, your finance comes entirely from student finance and is means-tested. This means you are eligible for up to £8,700 (will be more for London students) plus extra weeks allowance as Medicine is longer than other courses. I actually forgot about this extra allowance so I was shocked when my student finance came in and was significantly more than I was expecting!

Beyond first-year things get a bit complicated as you apply for finance and it comes in three different ways.

Firstly – You will get a non-means tested grant of £1000. That means you are guaranteed this amount. Whoop, and it’s a grant which means it’s £1000 less to pay back (she says writing this knowing full well the interest on her undergraduate degree is going to end up more than the actual degree).

Secondly- There is a means-tested NHS bursary of up to £2,643. This works the same way as student finance so will be tested against your parent’s income ( if you are still a dependent student but I will detail this later). You also get £84 per extra week so you can claim up to a maximum of £4,491.

Finally – You can still claim a lower rate of student finance at £2,324 which is still a loan and will drop in your final year to £1,744.

You may also claim for travel costs when on placement which involves a long form that you have to fill out.

PLEASE NOTE THIS FIGURES WILL CHANGE, SO PLEASE KEEP UP TO DATE WITH FINANCE WHEN YOU APPLY.

Additional help is available to students with families or if a student qualifies as a disabled student. You qualify as an independent student when you are over the age of 25. Until then, you need to make sure your parents keep their income information handy. If you are over 25 and living with a partner, their finances will be looked at so they need to keep their information handy.

If you have children you can claim for parent learning allowance which helps with childcare costs and is means-tested and non-repayable. This is the same if you have an adult dependant.

Finally, if you are a disabled student you can apply for DSA’s. This is not a lump sum in your bank account every term but provides equipment and help to disabled students. As a disabled student myself, I get help from a mentor ( basically someone to let my crazy out to every week) and I get printing allowances as I find working with paper easier.

In your first year, these are paid by student finance but after this, the NHS pays for them.

Repayments

Paying back the loans is the thing most people are worried about. However, you will not realise that you are paying them back as the money you pay back never reaches your bank account.

As it stands, any loans you took out before 2012 will start being paid back once you have started to earn over £18,330. However, now the figure is £25,000 and you pay back 9% for every £1000 earned over this threshold. This means if you earn £26,000, you will pay back £90 per year, not much.

However, what would the world be without interest!

You actually start paying back your loan as soon as you take the loan out, and if you are like me and going straight from one degree to another, that is potentially 7 years of pure interest ( lucky me). The interest rate at this point is the RPI +3%. When you start earning this drops to RPI only and then increases as your income increases.

So as you can see, it’s pretty straightforward. Just don’t let the repayments scare you, you won’t even earn enough as an F1 to even pay them back ! 😀

I’m curious, does this apply to the entirety of the UK? I know Student Finance screwed me over this year for my Masters. Rather than getting over £10,000 like students in England do – which is paid directly to them to do with as they please – Northern Ireland only offer £5,500 which is paid directly to the university and only covers fees. So even though my degree costs under £4,000, I don’t even get the change from that £5,500. But then again, I shouldn’t really expect much from a country where the politicians haven’t worked in almost two years, yet are still getting paid.

LikeLike

Firstly , congrats on getting your masters ! I know there are a few of our year still hanging around UCLan. Who is your supervisor ? I just had a quick glance at NI loans and they appear not to offer the maintenance loan at PG. ( I went through the undergrad route and where they talked about the maintenance loan on the UG they did not mention it for PG). Student Finance England does state that we get the £10,609 for the masters, might be worth calling them up and talking to SFE instead of SFNI ? Also, for the GEM courses it’s a different ball game altogether for funding . Essentially , you are doing another undergraduate degree but Stuent Finance does not pay the entire fee so you have to cover the gap in first year and the NHS does beyond. The NHS is the reason we get so much funding Might also be worth looking at PCDL loans : https://www.gov.uk/career-development-loans/eligibility

Might also be worth looking at PCDL loans : https://www.gov.uk/career-development-loans/eligibility

Also try the Harris bursary fund , you know about this one but I think you can claim for it as a postgraduate now 🙂 https://www.uclan.ac.uk/fundraising/harris_bursary_fund.php

LikeLike

Thanks. 🙂 John Marsh, it’s a big project he and a few others are working on so I’ll get to do a bit of travelling with it hopefully. And I talked to someone at SFE and they said I could apply for it but when I went to they stated that you had to live in England for three years but living in halls or student accommodation doesn’t count. If that’s the case, maybe I should ask for my money back for accommodation because if SFE doesn’t count halls as living in England then I must not have been here.

Just wish there was some kind of system in place that looked at what you studied rather than where you’re from. I came to England because neuroscience isn’t offered back home at any level, I’m not going to go back home and do nothing. And yeah, I’m going to have to apply for all I can. Hoping to get some demonstrating, marking, and whatever else they can give me as well.

LikeLike

I like your writing style really enjoying this internet site.

LikeLike

Hi! I know this is kind of off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

LikeLiked by 1 person

Hi – I was just having a play round with add ons when I found it I think !

LikeLike

An impressive share, I simply given this onto a colleague who was doing a bit analysis on this. And he in actual fact bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to debate this, I really feel strongly about it and love reading extra on this topic. If possible, as you change into experience, would you thoughts updating your blog with extra details? It is highly useful for me. Massive thumb up for this blog publish!

LikeLiked by 1 person

I do enjoy the manner in which you have framed this specific difficulty plus it does indeed present me some fodder for thought. Nonetheless, through what precisely I have seen, I basically hope as the actual comments pile on that individuals keep on point and in no way start upon a soap box of the news du jour. Yet, thank you for this excellent piece and although I do not go along with the idea in totality, I respect the perspective.

LikeLike

I want to convey my gratitude for your kind-heartedness in support of folks who have the need for help on this particular area. Your special dedication to passing the message all over came to be unbelievably advantageous and have consistently empowered somebody much like me to realize their targets. Your entire informative recommendations entails a lot to me and extremely more to my office colleagues. Regards; from each one of us.

LikeLiked by 1 person